U.S. Regulators Are Using an 80 Year-Old Lawsuit to Keep Crypto’s Goliaths Firmly Within Their Sights

Article by Frank America | Edited by Trewkat and Hiro Kennelly | Cover Art by ab_colours

SEC Origins and Purpose

Earlier this month, the U.S. Securities and Exchange Commission (SEC) took aim at Binance and Coinbase for allegedly operating cryptocurrency exchanges in violation of federal securities laws. Federal securities laws date back to the Securities Exchange Act of 1934, which saw the creation of the SEC and henceforth required registration from any company wishing to operate a brokerage, exchange, or clearing house for financial transactions. According to the SEC website, the Act has two main goals:

- require that investors receive financial and other significant information concerning securities being offered for public sale; and

- prohibit deceit, misrepresentations, and other fraud in the sale of securities.

Basically, if your business is telling people they could potentially make money by giving you money, you have to register with the SEC first.

The Howey Test

This line of thinking came to a head in the mid-1940s when the owner of a Florida orange grove was sued by the SEC. In deciding SEC v. W.J. Howey Co, the U.S. Supreme Court created a 4-prong test as to whether or not something is being sold as a security, or in other words, constitutes an investment contract. W.J. Howey subsequently lost the case against the SEC and was cited for not registering his leaseback contracts to investors as securities.

The SEC established these four criteria, all of which need to be satisfied for something to be determined an investment contract:

- An investment of money

- In a common enterprise

- With the expectation of profit

- To be derived from the efforts of others.

While SEC Chair Gary Gensler has been asked to provide further clarification around blockchain, crypto, and decentralized finance as a form of an investment contract, the SEC remains quiet and has instead opted to provide clarification via enforcement actions. This is what led to the charges against Binance and Coinbase.

Is Crypto an Orange Grove?

When it comes to cryptocurrencies, there is a lot of nebulous territory. For example, staking your crypto on a centralized exchange is presumably a different animal than using a decentralized finance smart contract. A token that had an initial token offering may be something different than one that merely provides governance rights. Tokens that offer staking and rewards, or tokens which are largely centralized, seem to be in a different category than those that don’t. None of these nuances have been adjudicated, and all that U.S.-based crypto enterprises can do is to see what enforcement actions are occurring and what can be implied from them.

Under the SEC’s take in the Binance and Coinbase lawsuits, the following tokens (in no particular order) may, like Howey’s orange grove contracts, be securities:

SOL | ADA | MATIC | COTI | ALGO FIL | ATOM | SAND | AXS |

MANA | BNB | VGX | CHZ | NEAR | FLOW | DASH | NEXO | ICP

Noticeably missing from this list is ether (ETH), which may prompt a sigh of relief from many. Although Gensler wouldn’t comment on whether or not the SEC believes ETH is a security, the fact that it hasn’t been listed in this initial tranche bodes well for the Ethereum blockchain and its native token. Bitcoin has managed to escape the ire of centralized authority and is largely considered to be sufficiently decentralized and therefore not a security.

Nearly all tokenized crypto projects get hung up on the fourth prong of the Howey Test, which looks to see whether any investment profits are to be derived from the efforts of others. Coin Bureau recently put up a YouTube video analyzing this aspect of the Howey Test, text from which is below:

Derived from the efforts of others meaning that the expectation of profit is coming from an identifiable third party, be it an institution, an individual, or some combination of both. Now obviously almost every cryptocurrency meets the first three criteria. It’s the fourth criterion where things can get complicated. That’s because sometimes it’s not easy to identify a third party that’s creating an expectation of profit for a particular coin or token. These are quote “sufficiently decentralized�?. Now this quote comes from former SEC director Bill Hinman who said that ETH is not a security because it was “sufficiently decentralized.�?�?

Coin Bureau

Is FLOW sufficiently decentralized? As a centrally operated company, probably not. But is Ethereum? It seems one could argue either way. Chairman Gensler told Jim Cramer from CNBC his thoughts:

“This is a highly speculative asset class. We’ve known this for a long time; the ups and downs of this speculative asset class�?—�?Bitcoin and hundreds of other tokens… And the investing public is… hoping for a return, just like when they invest in others financial assets we call securities. And many of these financial assets, crypto financial assets, have the key attributes of a security.�?

“So, some of them, they’re under the Securities and Exchange Commission. Some, like Bitcoin, and that’s the only one, Jim, I’m gonna say because I’m not going to talk about any one of these tokens but my predecessors and others have said they’re a commodity.�?

Binance and Coinbase

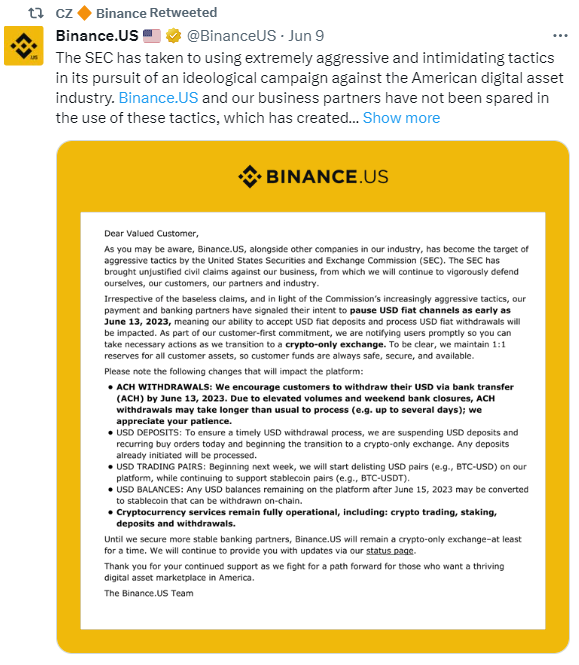

Binance is the largest cryptocurrency exchange in the world, and Coinbase is the largest cryptocurrency exchange in the United States. The SEC is laying 13 charges against Binance, the operative ones being running an unlicensed securities exchange, brokerage, and clearing house. That means they’re providing the platform for a securities exchange, executing buy and sell orders on behalf of their customers (brokerage-dealer), and making a spread on the margins of those buy and sell orders (clearing house). On top of this, the SEC accuses Binance of positioning the BNB token as a “a so-called security�?, BUSD as a “so-called stablecoin�?, and takes issue with Binance offering staking as a service and providing crypto loans. It doesn’t seem likely that as a centrally operated company Binance could argue that it is sufficiently decentralized. However, we’ll see. To be clear the SEC is going after Binance.US and its CEO, Changpeng Zhao, as they can’t charge a company outside their jurisdiction.

Coinbase launched an IPO a few years back, catching a valuation of 86 billion USD. During this process they opened their books and operations to the SEC, which basically took a peek and said it looks good for now, but left some fine print in case they want to change their mind.

Coinbase’s Chief Legal Officer and CEO have both been very vocal that they’ve tried to get regulatory insight from the SEC, such as whether or not to activate their brokerage license, but have been met largely with silence. As of June 6, 2023, the SEC is charging Coinbase with operating an unregistered securities exchange, as well as being a broker, and a clearing house. Armstrong noted that while the conversation had once been more of a dialogue, this last year turned to probing questions about their business operations and silence when Coinbase asked anything. Armstrong told Fortune magazine they have more than $5 billion on the balance sheet to handle legal fees. I think it’s safe to say they’re ready for a good ol’ fashioned dust-up.

Where to Go From Here?

The hot take here is that regulatory clarity, regardless of the outcome, will be a net gain for the crypto industry. Either all these tokens are securities (and many, many others) and Coinbase has to delist them and pay fines for having sold them, or these tokens are not securities and the SEC can go pound sand. Regardless, the market economy will react.

Crypto will either be driven from the U.S. towards more friendly jurisdictions in what’s known as regulatory arbitrage, or it will be encouraged to stay. Speculation that this attack on crypto, as opposed to the conversation that could have occurred, is loosely built around the prospect of a Centralized Bank Digital Currency (CBDC), is worth considering�?—�?if only because Chair Gensler himself doubled down on digital currency and said, “Look, we don’t need more digital currency. We already have digital currency. It’s called the U.S. dollar. It’s called the euro or it’s called the yen; they’re all digital right now. We already have digital investments.�?

So what’s to come of all this? Either crypto money moves offshore or it doesn’t, but either way the markets like clarity and can build on that. Either Binance and Coinbase broke the rules or they didn’t, but either way way the industry will build out stronger and put this current battle in the past.

Hodl on, ser.

Author Bio

Frank America is an author, comedian, and musician. Frank is Editor-in-Chief of The Rug News, and a Content Manager/Staff Writer at Bankless Publishing.

Editor Bios

Trewkat is a writer and editor at BanklessDAO. She’s interested in learning about crypto and NFTs, with a particular focus on how best to communicate this knowledge to others.

Hiro Kennelly is a writer, editor, and coordinator at BanklessDAO, an Associate at Bankless Consulting, and is still a DAOpunk.

Designer Bio

ab_colours is a versatile designer with over seven years of experience. He specializes in doing product design, UX design and brand identity. He has been DAOing for the past eight months and has been able to amass quite a lot of knowledge about the fascinating blockchain space.

BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here!

More Like This

Banning Blockchain by Vi-Fi

Regulating Through Right, Not Might by Joshua Kaycè-Ogbonna

The Crazy World of Bitcoin by Tigi76