These Powerful Decentralized Exchange Platforms Are the Search Engines of DeFi

Article by oxdog | Edited by Trewkat | Cover Art by ab_colours

When you want to swap your tokens, you have countless DeFi exchanges (DEXs) to choose from, whether Uniswap, TraderJoe, dYdX, or Curve. Every exchange has ever-changing swap prices and varying slippages. With over 214 DEXs listed on Coingecko, you will never get the best possible price and slippage relying only on your DEX of choice. But searching all DEXs for the best price is unreasonable, and fortunately you also don’t need to do it. This is precisely what DEX aggregators are built for. They are a search engine of decentralized exchanges to find you the best conditions for your trade across all of DeFi. What are they, how do they work, and what are the best aggregators?

What Are DEX Aggregators

You can compare DEX aggregators to search engines for hotels. When you search for a hotel to stay in, you have hundreds of options to choose from. If you are a maniac, you will visit every hotel’s website individually and compare prices. If you are an ordinary person, you use a hotel search engine like Trivago that helps you find the best fit. It saves you time and money!

When you visit the same DEX over and over again, it is like staying at the same hotel chain every time you travel. It is convenient, yet you will likely miss out on lower prices and more beautiful stays. DEX aggregators are here to help.

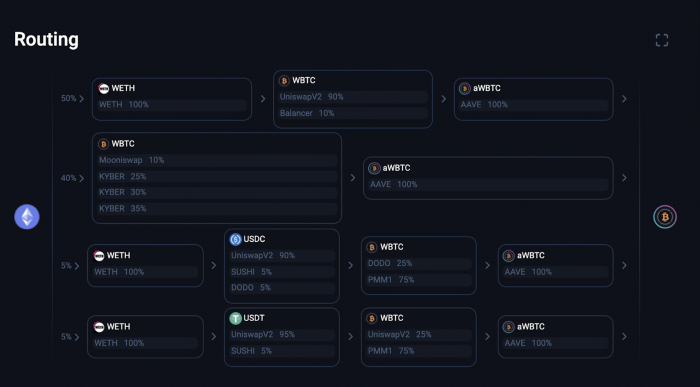

Decentralized finance is built on liquidity that users provide. The swap rate and slippage on these exchanges are determined by a formula that calculates it based on the underlying liquidity of the DEX. Because liquidity is constantly changing, prices fluctuate with it. DEX aggregators monitor all liquidity sources across DeFi and use sophisticated algorithms to detect the most favorable rates with the least slippage. When you trade on an aggregator, you are still using the underlying DEX protocol, but the aggregator decides which one is the best for you. They can even split up your trade across multiple exchanges to give you even better conditions.

1inch

1inch is the #1 Dex aggregator with over $236B+ in total volume, 265 liquidity sources, and it is available on nine chains (Ethereum, Binance Chain, Polygon, Optimism, Arbitrum, Gnosis, Avalanche, Fantom, and Klaytn). The aggregator can also be used for yield farming and has its gas token named Chi, which can be burnt on trade to save gas.

1inch also has a mobile wallet (ios/android) where you can store your assets, buy crypto with fiat, transfer on multiple networks, swap tokens, and stake the 1inch token to gain governance rights and eventually be eligible for gas refunds.

Here you can find many more 1inch stats.

Paraswap

Paraswap is similar to 1inch, yet not as significant with a total volume of $30B and it is only deployed to six chains (Ethereum, Polygon, Binance Chain, Avalanche, Fantom, Arbitrum).

A benefit of trading on Paraswap is the Gas refund program. When you stake a certain amount of PSP, you can enjoy up to a 100% gas refund. For example, if you stake 5,000 PSP, which equals around $100 at $0.023 per token, you get 50% of your gas refunded.

Also, Paraswap recently opened early access to their mobile app. Currently, it is only available for iOS users, and you have to stake PSP to be eligible. If you are curious, you can find more information here and more stats about Paraswap here.

More Options

Besides 1inch and Paraswap, you have other options you can trade on, including:

On the Lookout

In the future, it will be uncommon to visit a DEX or aggregator directly. As wallets’ functionality and user experience improve, DEX aggregators will be built directly into them. So instead of opening your browser, visiting an aggregator, connecting your wallet, and initiating a transaction, you will hit a swap button in your wallet app, which uses an aggregator under the hud. Many wallets already have this implemented. For example, if you have ever used the swap feature on MetaMask, then you have used an aggregator since MetaMask implements the same 0x API that Matcha uses.

If you never tried a DEX aggregator, now is your time. It will immediately pay off by saving you money that would otherwise be lost on every trade you make.

Bios

Author

oxdog is on a 4-year daily meditation run streak, and soon he will be able to levitate and say no to chairs // React TS Solidity Developer // Contributor BanklessDAO.

Editor

Trewkat is a writer and editor at BanklessDAO. She’s interested in learning as much as possible about crypto and NFTs, with a particular focus on how best to communicate this knowledge to others.

Designer

ab_colours is a versatile designer with over seven years of experience. He specializes in doing product design, UX design and brand identity. He has been DAOing for the past eight months and has been able to amass quite a lot of knowledge about the fascinating blockchain space.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains.

Bankless Publishing is always accepting submissions for publication. We’d love to read your work, so please submit your article here!

More Like This

Distributed Ledger Technology 101 by The Crypto Barista

Cryptocurrency Wallets 101 by ijeblowrider

The 101 on NFTs, A Briefing by Lanz